extended child tax credit dates

The remainder of your money will come with your tax refund this year after you file your 2021 tax return. W ith Novembers payment now out the IRS is down to one payment left this year coming in December.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

This means that the total advanced credit.

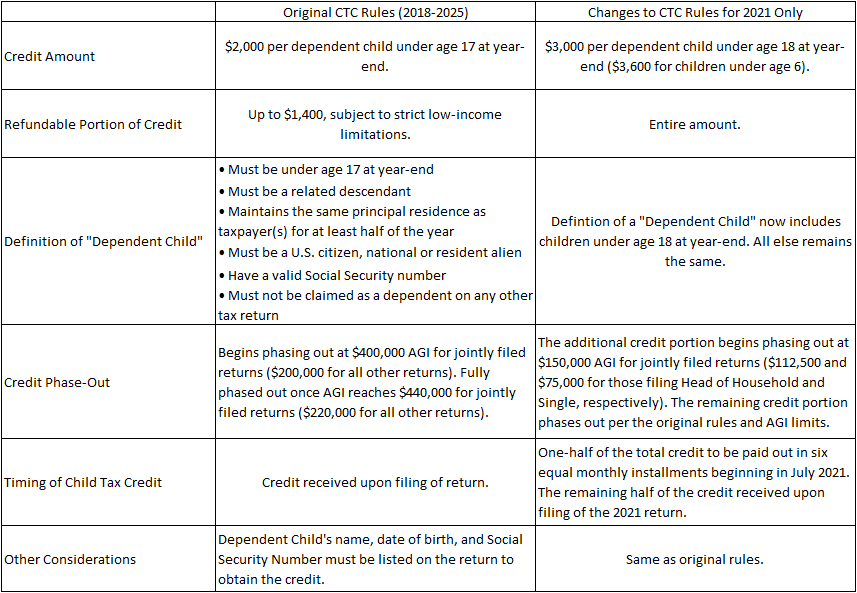

. The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. 15 The payments will be made either by direct deposit or by paper check depending on what. Meanwhile the Internal Revenue Service IRS says it will need time to resume child tax credit payments when the time comes.

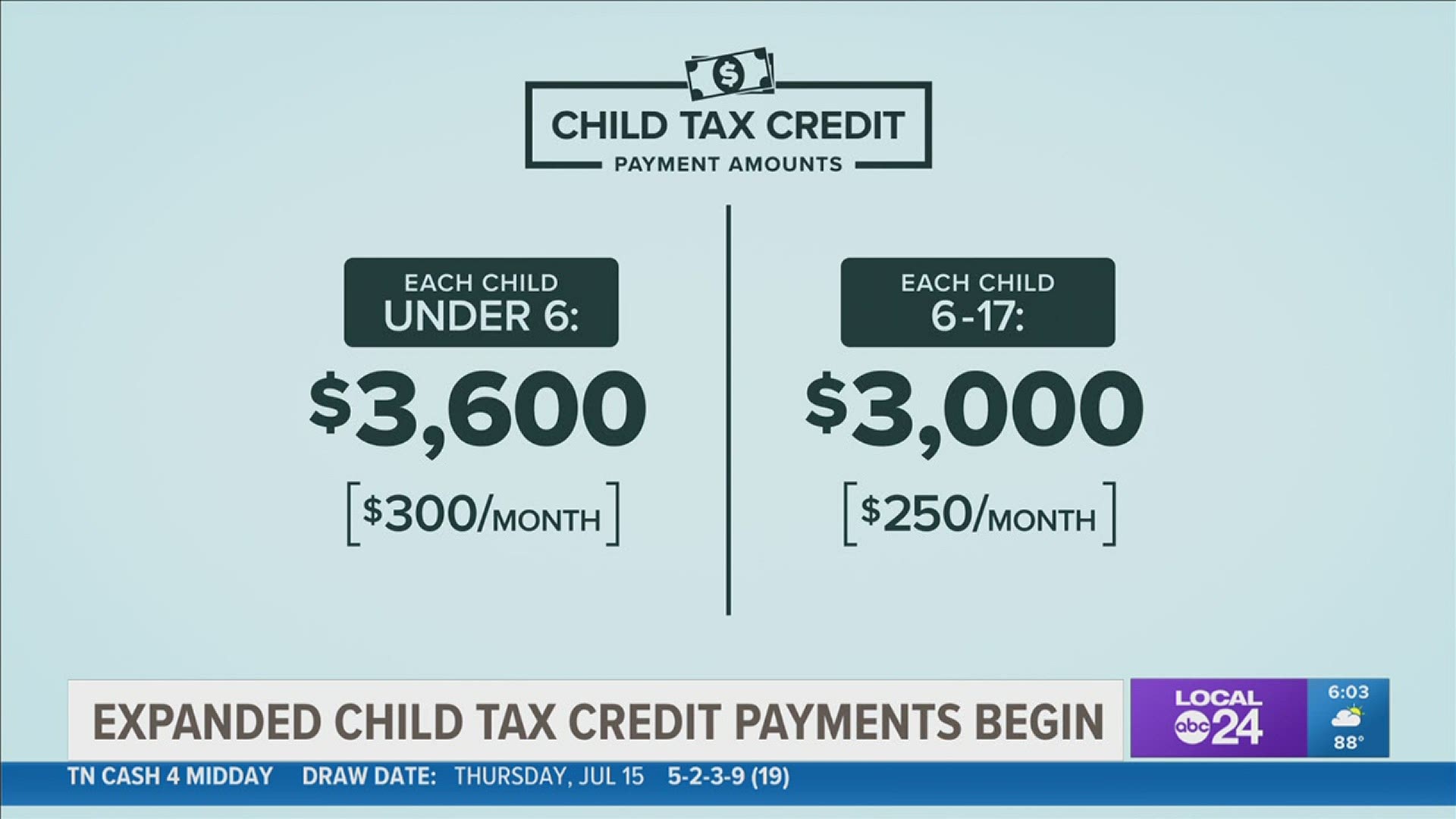

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. Be under age 18 at the end of the year.

The cost of extending it until 2025 has been. But if Bidens nearly 2 trillion American Families Plan ever gets. The enhanced child tax credit expired at the end of December.

The last checks issued went out on the 15th of the month leaving millions of families. While the IRS did extend the 2020 and 2021 tax filing dates due to the. Under the current plan the child tax credit will financially assist eligible parents through the end of this year.

Change language content. The Joint Committee on Taxation estimated that the 2021 advance child tax credits expansion would cost 110 billion. Visit ChildTaxCreditgov for details.

The 6 monthly Child Tax Credit payment amounts will total. Heres an overview of what to know. And while for many the checks and direct deposits have arrived on time each.

31 2021 the expanded child tax credit expired when Congress failed to renew it. Here are the official dates. Unless Congress takes action the 2020 tax credit rules apply in 2022.

For children under age 6. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. To be a qualifying child for the 2021 tax year your dependent generally must.

For children age 6 through 17. The IRS sent the last child tax credit payment. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

That legislation has since stalled.

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

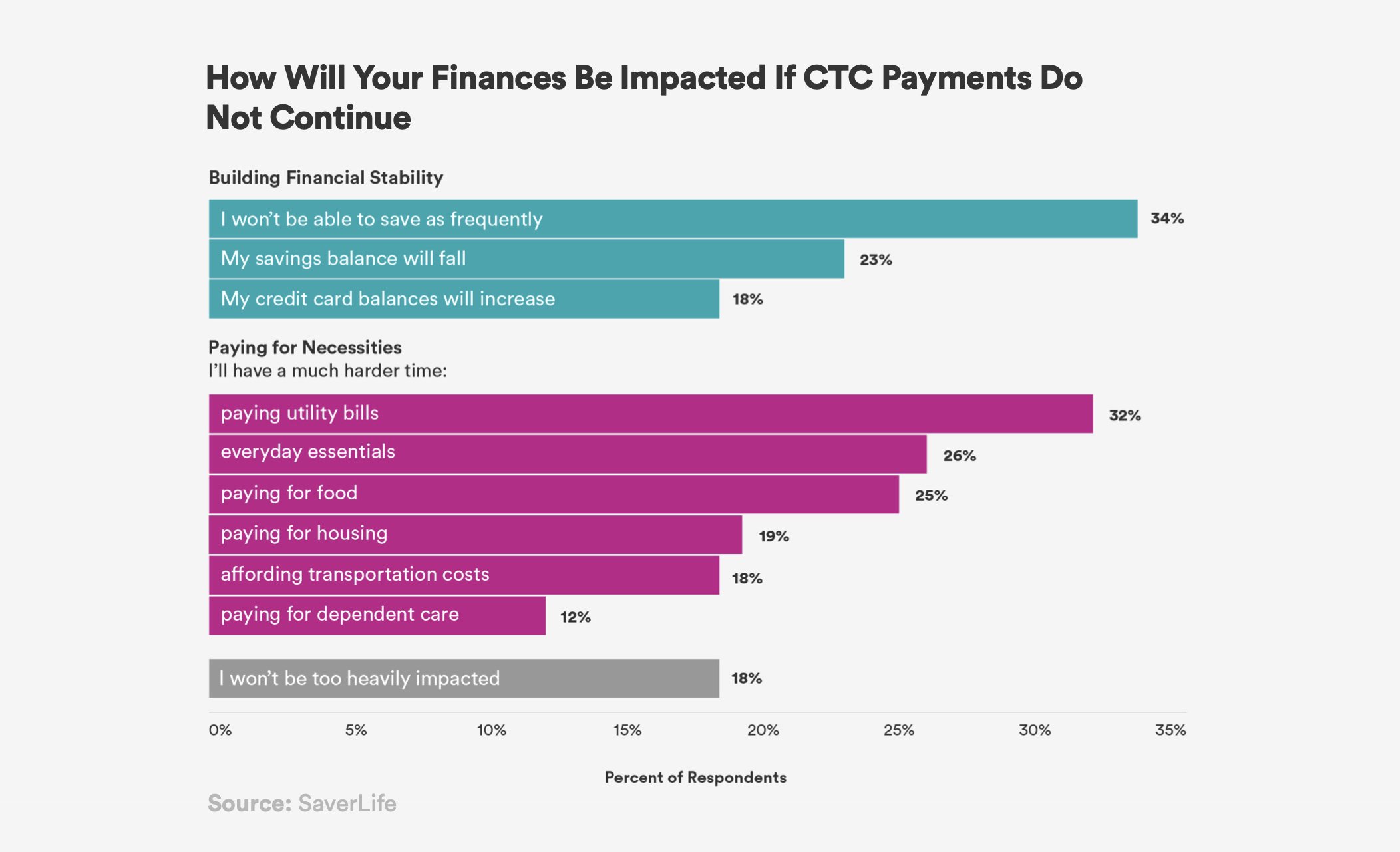

Child Tax Credit About Saverlife

Child Tax Credit Payment Dates For Final 300 Lump Sum Of 1800 Itech Post

What The Expanded Child Tax Credit Means To Families Localmemphis Com

Status Of Child Tax Credit Where Is It Do You Want It

When Will Families Receive The Advanced Child Tax Credit The Dates You Need To Know Fox Business

Advance Child Tax Credit Payments Begin July 15

Institute Index Keeping The Expanded Child Tax Credit Would Ease The South S Child Poverty Crisis Facing South

Stimulus Update Last Child Tax Credit Payment In December Important Deadline Ahead Al Com

Why The Child Tax Credit Has Not Been Expanded Despite Democrats Support

The Child Tax Credit Grows Up To Lift Millions Of Children Out Of Poverty Tax Policy Center

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

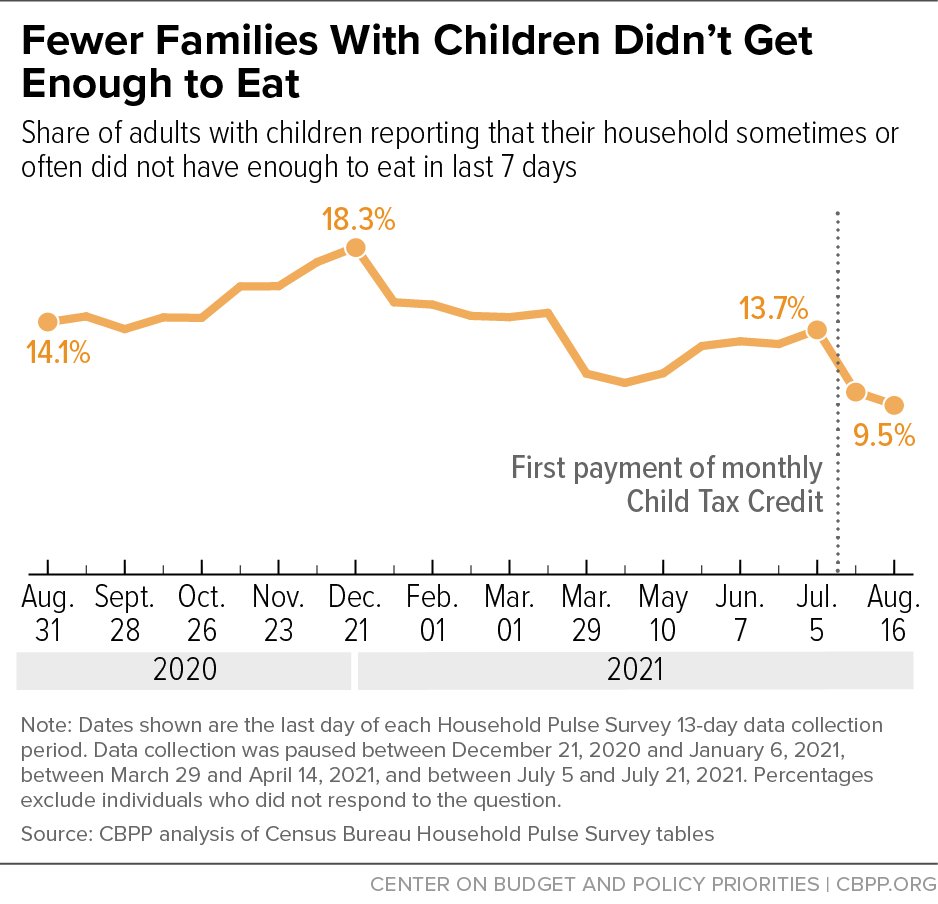

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat San Diego For Every Child

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

The Anti Poverty Targeting And Labor Supply Effects Of The Proposed Child Tax Credit Expansion The University Of Chicago Harris School Of Public Policy

Kentucky Indiana Families To Benefit From Child Tax Credit Whas11 Com

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors